arizona estate tax exemption 2021

The estate tax rate is based on the value of the decedents entire taxable estate. Up to 25 cash back Arizona is not a state that will allow a married couple to double the homestead exemption amount.

How To Avoid Estate Taxes With A Trust

It is to be filled out completely by the purchaser and furnished to the vendor at the time of the sale.

. The current federal estate tax is currently around 40. For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021. This means that on the federal level if your estate is valued at less than 11580000 when you die then your beneficiaries will not have to pay any federal tax on their inheritance.

If such an election was made her husband would then be able to leave 8000000 estate tax-free by using his own exemption of 5000000 plus his deceased wifes unused exemption of 3000000. Ad Register and Subscribe Now to Work on AZ ADEQ More Fillable Forms. The current federal policy states that capital gains taxes can be collected only from the sale of assets that have been held for over a year.

The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return. All estates in the United States that are worth more than 549 million as of 2017 are required to pay an estate tax. The 2021 standard deduction is 12550 for single taxpayers or married filing separately.

Arizona offers a standard and itemized deduction for taxpayers. The District of Columbia moved in the opposite direction lowering its estate tax exemption from 58 million to 4 million in 2021 but simultaneously dropping its bottom rate from 12 to 112 percent. In Arizona it doesnt matter whether a single person or married couple claims an exemption on a homesteadthe property will be exempt only up to the 150000 maximum homestead amount.

Ad Download Or Email AZ ADEQ More Fillable Forms Register and Subscribe Now. 25100 for married couples. The Internal Revenue Service announced today the official estate and gift tax limits for 2021.

TPT Exemption Certificate - General. The rates for long-term capital gains taxes are 0 15 and 20 depending on the tax. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020.

In 2020 it set at 11580000. No estate tax or. All of the rules in the 2010 tax law were scheduled to end on January 1 2013 unless Congress acted to extend.

A federal estate tax is in effect as of 2021 but the exemption is significant. The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return. 4 The federal government does not impose an inheritance tax.

Federal law eliminated the state death tax credit effective January 1 2005. The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is scheduled to match the federal amount in 2023 Delaware. Final regulations user fee for estate tax closing letter td 9957 pdf establishing a new user fee of 67 for persons requesting the issuance of irs letter 627 estate tax closing letter etcl will be effective october 28 2021.

The purpose of the Certificate is to document and establish a basis for state and city tax deductions or exemptions. The tax rate ranges from 116 to 12 for 2022. No estate tax or inheritance tax.

Even though Arizona does not have its own estate tax the federal government still imposes its own tax. For married couples that goes up to 500000. Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from 20 million to 15 million which represents the tax due on a Connecticut estate of approximately 129 million.

For single sellers the first 250000 made from the sale of the home will be exempt from capital gains taxes. Ad Download Fill Sign or Email the file More Fillable Forms Register and Subscribe Now. 1828 enacting comprehensive Arizona individual income tax reform.

This Certificate is prescribed by the Department of Revenue pursuant to ARS. This means that when someone dies and. Federal exemption for deaths on or after January 1 2023.

Federal estate tax return due nine months after the individuals death though an automatic six-month extension is available if asked for prior to the conclusion of the nine-month period This is required only of individual estates that exceed a gross asset and prior taxable gift value of 1206 million 2412 for couples in 2022. The federal inheritance tax exemption changes from time to time. Starting in 2022 the exclusion amount will increase annually based on.

Download Or Email AZ ADEQ More Fillable Forms Register and Subscribe Now. This means that assets purchased and sold within the timeframe of a year will be taxed only as ordinary income. Arizona follows the equation for Federal capital.

The top estate tax rate is 16 percent exemption threshold. Property Qualifying for the Arizona Homestead. Because Arizona conforms to the federal law there is.

On June 30 2021 Arizona Governor Doug Ducey signed into law SB. 2013 Estate and Gift Tax Law Changes. Of all the states Connecticut has the highest exemption amount of 91 million.

The Arizona State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Arizona State Tax Calculator. Starting in 2023 it will be a 12 fixed rate. Here in Arizona if homeowners have lived in their main home for less than two years they will be liable to pay capital gains taxes.

Arizona State Personal Income Tax Rates and Thresholds in 2022. The director by rule may exempt specifically described classes or categories of facilities from the aquifer protection permit requirements of this article on a finding either that there is no reasonable probability of degradation of the aquifer or that aquifer water quality will be maintained and protected because the discharges from the facilities are. The amount of the estate tax exemption for 2022.

117 million increasing to 1206 million for deaths that occur in 2022. 31 2021 can be prepared and e-Filed now along with your Federal or IRS Income Tax Return or you can learn how to complete and file only an AZ state return. The estate and gift tax exemption is 117 million per individual up from 1158 million in.

The federal estate tax exemption is 1170 million for. The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020. The arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return.

Take a look at the table below. This exemption rate is subject to change due to inflation.

Irs Announces Higher Estate And Gift Tax Limits For 2020

How To Avoid Estate Taxes With A Trust

Income Tax Clip Art Bing Images Tax Preparation Credit Repair Business Best Credit Repair Companies

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

What Is The New Estate Tax Exemption For 2021 Phelps Laclair

This Tax Brings In Billions Worldwide Why There S No Vat In The U S

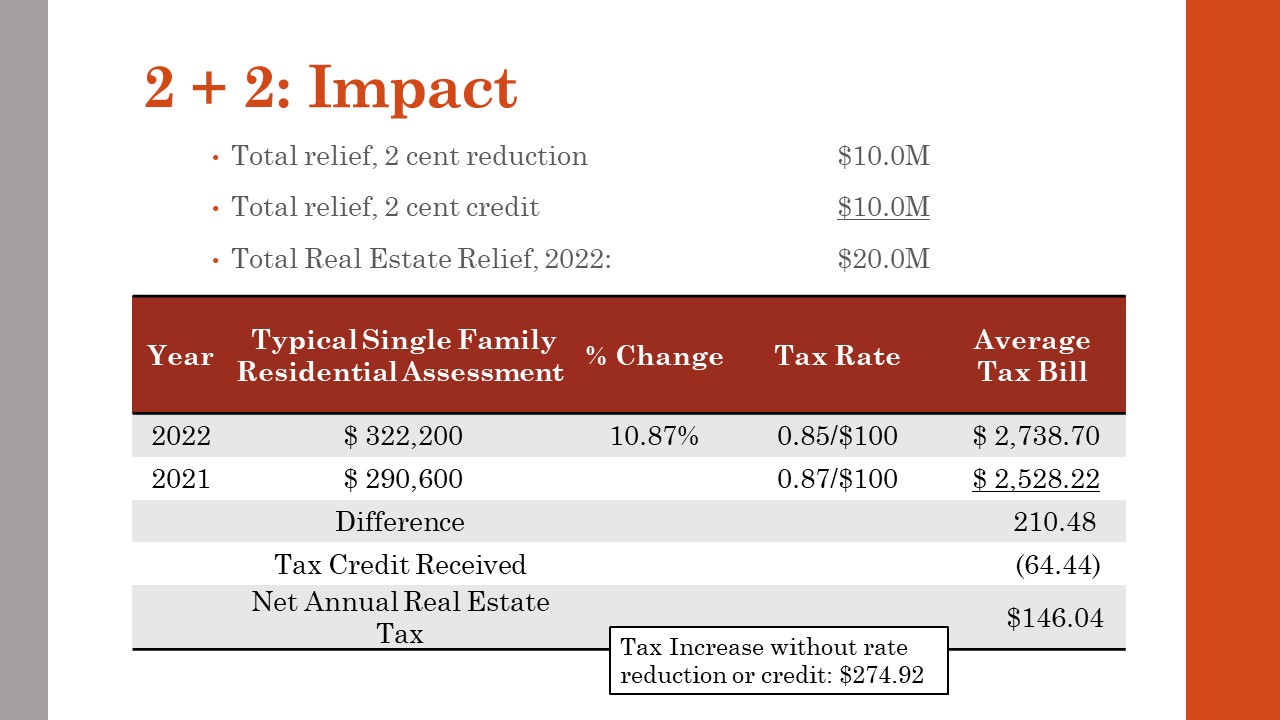

Henrico Approves Ordinance To Offer First Ever Real Estate Tax Credit Henrico County Virginia

Deducting Property Taxes H R Block

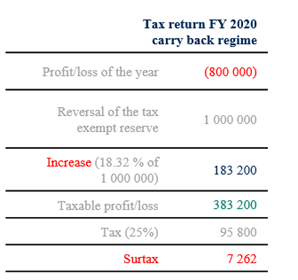

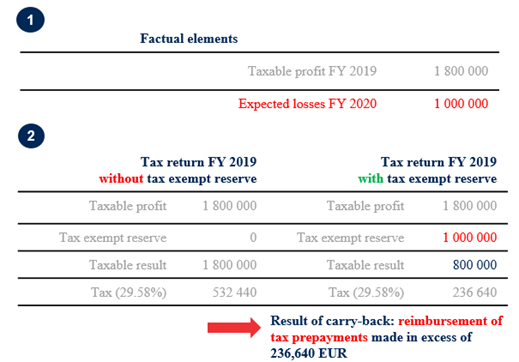

Belgian Law Introducing One Off Loss Carry Back Regime Published In The Official Journal Belgium Tax Iclg Com Briefings

What Is Inheritance Tax And Who Pays It Credit Karma Tax

Property Tax How To Calculate Local Considerations

A Way To Lock In The Current Estate Tax Exemption To Benefit Your Spouse

State Death Tax Hikes Loom Where Not To Die In 2021

Belgian Law Introducing One Off Loss Carry Back Regime Published In The Official Journal Belgium Tax Iclg Com Briefings

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)